The real estate market has long been a cornerstone of investment portfolios, offering opportunities for both steady income and asset appreciation. As 2024 unfolds, several new trends and shifts are shaping the industry. From the rise of technology-driven investments to the growing importance of sustainability, real estate investors need to stay ahead of these developments to make informed decisions. Here’s a deep dive into the top real estate investment trends that are set to dominate the market in 2024.

Contents

- 1 1. Technology-Driven Real Estate Investments

- 2 2. Sustainability and Green Buildings

- 3 3. Urbanization and the Rise of Smart Cities

- 4 4. Short-Term Rentals and the Sharing Economy

- 5 5. Suburban Boom and the Shift Away from Major Cities

- 6 6. The Role of Interest Rates and Inflation

- 7 7. Remote Work and Its Impact on Commercial Real Estate

- 8 8. Demographic Shifts and Real Estate Demand

- 9 9. Globalization of Real Estate Markets

- 10 Conclusion

1. Technology-Driven Real Estate Investments

In 2024, the intersection of real estate and technology continues to revolutionize how investors approach the market. PropTech (property technology) is at the forefront, offering solutions that streamline processes such as property management, buying, selling, and investing.

- Blockchain and Smart Contracts: Blockchain technology is transforming real estate transactions by offering transparency, reducing fraud, and eliminating intermediaries. Smart contracts allow for secure, automated property transfers, ensuring faster and more reliable deals. Real estate tokenization, where properties are divided into shares that can be traded like stocks, is also gaining popularity.

- Artificial Intelligence and Big Data: AI is playing a pivotal role in real estate, from predicting property values to improving decision-making. Big data allows investors to analyze vast amounts of information on market trends, demographics, and property performance, helping them make more informed investment choices.

- Virtual Reality and Augmented Reality: Virtual tours and augmented reality applications are becoming standard in property marketing. Investors can now explore properties remotely, saving time and resources.

2. Sustainability and Green Buildings

Sustainability has moved from being a buzzword to a critical factor in real estate investment. As environmental concerns grow, more investors are focusing on green buildings and energy-efficient properties.

- LEED Certification and Green Building Standards: Properties that meet Leadership in Energy and Environmental Design (LEED) standards or other sustainability certifications are increasingly appealing to investors. Green buildings tend to have lower operating costs, higher tenant satisfaction, and can command premium rental rates.

- Net-Zero and Carbon-Neutral Buildings: In 2024, more developers are embracing the goal of creating net-zero and carbon-neutral buildings. These properties generate as much energy as they consume, making them attractive to environmentally conscious investors and tenants.

- ESG (Environmental, Social, Governance) Investment Strategies: ESG-focused investment strategies are growing in popularity. Investors are looking at properties not just for their financial returns, but for their environmental and social impacts. Properties that meet ESG criteria are often seen as lower-risk, long-term investments.

3. Urbanization and the Rise of Smart Cities

The ongoing trend of urbanization continues to shape real estate investments. As more people move to urban centers, the demand for smart cities – cities that leverage technology to improve the quality of life – is on the rise.

- Smart City Infrastructure: Cities are incorporating intelligent infrastructure like IoT (Internet of Things) sensors, 5G networks, and smart grids. These innovations create more efficient, sustainable, and livable urban environments. Investors are increasingly attracted to properties in cities with strong smart city initiatives.

- Mixed-Use Developments: Mixed-use properties that combine residential, commercial, and recreational spaces in one development are gaining popularity. These properties cater to the demands of urban dwellers who seek convenience and accessibility in their daily lives.

- Transit-Oriented Developments (TOD): Proximity to public transportation is becoming a key consideration for investors. TODs, which are mixed-use developments near transit hubs, are in high demand as cities aim to reduce car dependency and promote sustainable living.

4. Short-Term Rentals and the Sharing Economy

The rise of platforms like Airbnb has revolutionized the short-term rental market, and this trend is continuing into 2024. Short-term rentals offer flexibility and the potential for higher returns than traditional long-term leases.

- Vacation Rentals: With the growth of the travel industry, vacation rentals are a lucrative investment, especially in popular tourist destinations. Investors are leveraging platforms like Airbnb to manage these properties efficiently.

- Corporate Housing: As remote and hybrid work models continue to expand, corporate housing is becoming a hot market. Companies are increasingly renting short-term housing for employees on temporary assignments, creating demand for furnished rental properties in business hubs.

- Regulatory Changes: However, it’s important for investors to stay aware of evolving regulations in the short-term rental space. Many cities are introducing stricter rules, including caps on the number of nights a property can be rented out and zoning restrictions.

5. Suburban Boom and the Shift Away from Major Cities

While urban centers have historically been prime real estate markets, there has been a noticeable shift toward suburban areas in recent years. The COVID-19 pandemic accelerated this trend, and it continues to shape the market in 2024.

- Suburban Migration: Remote work has allowed more people to move away from expensive city centers to more affordable suburban or even rural areas. This has led to increased demand for single-family homes, townhouses, and other residential properties outside of urban cores.

- Suburban Commercial Real Estate: Along with residential demand, suburban commercial real estate is also seeing growth. Retail centers, office spaces, and coworking hubs in suburban areas are becoming attractive investments as businesses adapt to new work patterns.

- Affordable Housing Initiatives: In response to affordability crises in major cities, there has been a push for affordable housing development in suburban areas. Investors can take advantage of government incentives and tax breaks aimed at increasing the supply of affordable homes.

6. The Role of Interest Rates and Inflation

Economic factors such as inflation and interest rates continue to influence the real estate market. As 2024 progresses, investors must be mindful of how these variables impact property values and mortgage rates.

- Rising Interest Rates: Central banks around the world have been raising interest rates to combat inflation. This has led to higher borrowing costs, which can affect the affordability of real estate investments. Investors need to carefully consider their financing options in this high-interest-rate environment. Real estate investor software provides valuable insights to navigate these challenges and evaluate potential returns accurately.

- Inflation Hedge: Despite the challenges posed by rising interest rates, real estate remains an effective hedge against inflation. As inflation pushes up the cost of goods and services, property values and rental rates tend to rise as well, offering protection for investors.

7. Remote Work and Its Impact on Commercial Real Estate

The remote work revolution has had a profound impact on commercial real estate, and this trend will continue to evolve in 2024.

- Flexible Workspaces: As businesses shift to hybrid work models, the demand for flexible office spaces is on the rise. Coworking spaces and shared office environments offer flexibility to companies that no longer require large, permanent office spaces.

- Repurposing Commercial Properties: Many investors are capitalizing on the changing demand for office space by repurposing commercial properties. Vacant office buildings are being transformed into residential units, hotels, or mixed-use developments, creating new investment opportunities.

- Resilient Retail Spaces: While e-commerce continues to grow, the demand for physical retail spaces remains resilient. Investors are focusing on experiential retail properties, where stores offer unique, interactive experiences that can’t be replicated online.

8. Demographic Shifts and Real Estate Demand

Demographic changes are shaping the types of properties that are in demand in 2024. Two key groups – millennials and baby boomers – are influencing real estate trends.

- Millennial Homebuyers: As millennials enter their prime homebuying years, there is a growing demand for affordable housing, especially in suburban and secondary markets. This generation values flexibility, community amenities, and sustainability in their housing choices.

- Aging Baby Boomers: The aging baby boomer population is driving demand for senior housing, retirement communities, and healthcare-related real estate. Investors can explore opportunities in these niche markets, which are expected to see significant growth in the coming years.

9. Globalization of Real Estate Markets

In 2024, real estate investment is becoming more globalized than ever before. Cross-border investments are increasing as investors seek opportunities in emerging markets and diversify their portfolios.

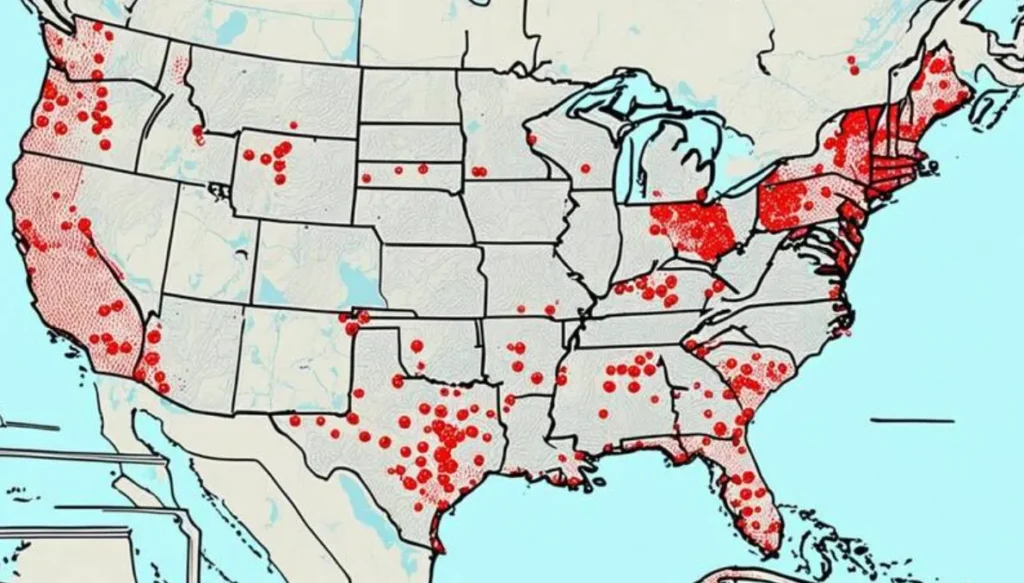

- Foreign Investment in U.S. Real Estate: The U.S. remains a popular destination for foreign investors, particularly in gateway cities like New York, Los Angeles, and Miami. Investors from Asia, Europe, and the Middle East are attracted to the stability and growth potential of U.S. real estate.

- Investing in Emerging Markets: Investors are also looking at emerging markets in Asia, Africa, and Latin America, where urbanization and population growth are driving demand for housing, commercial space, and infrastructure development.

Conclusion

The real estate market in 2024 is defined by technological innovation, sustainability, shifting demographics, and evolving economic conditions. Investors who stay informed about these trends will be better equipped to navigate the complexities of the market and make sound investment decisions. Whether it’s embracing PropTech, investing in sustainable developments, or capitalizing on the shift to suburban living, the opportunities for growth and diversification in real estate are vast. By keeping an eye on these trends, investors can position themselves for success in the dynamic world of real estate.