Technical analysis is a toolbox with endless options, and sometimes, combining a few can give investors a better picture of market trends. The Moving Average Convergence Divergence (MACD) and Price Channels are two popular tools that, when used together, can add layers of insight to your trading strategy. Let’s dive into these indicators and see how pairing them can help traders make more informed decisions. Looking to deepen your strategy with MACD and price channels? Go ai-growthmatrix.org now and start learning from professional education firms.

Contents

Understanding MACD and How It Works?

The MACD, or Moving Average Convergence Divergence, is a momentum indicator that tracks changes in price direction. At its core, MACD measures the difference between two moving averages—a “fast” one and a “slow” one. The fast-moving average responds quickly to price changes, while the slow one moves more gradually. When these two averages cross, they signal potential shifts in momentum.

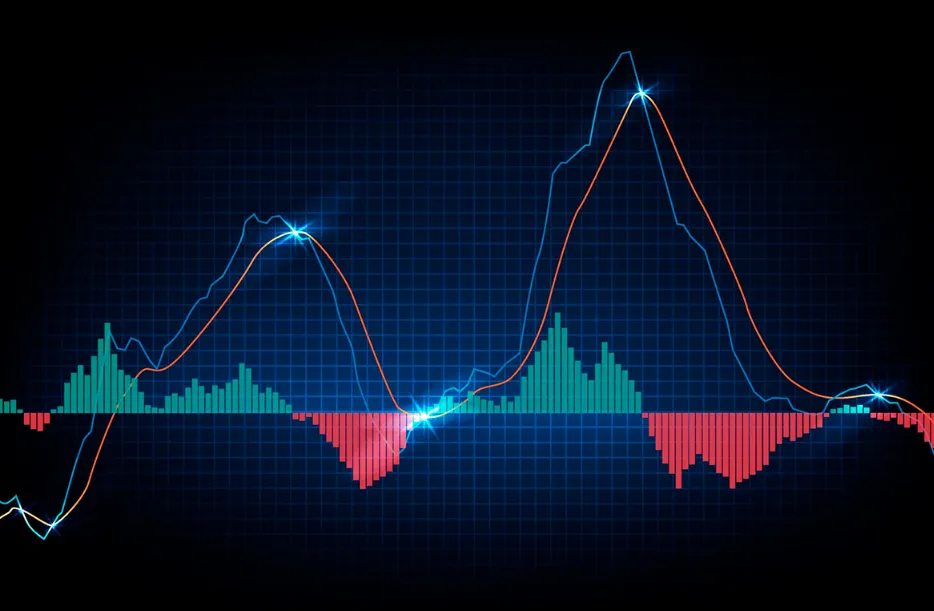

The MACD has three main components: the MACD line, the signal line, and the histogram. The MACD line represents the gap between the fast- and slow-moving averages. The signal line, a smoother version of the MACD line, is used to confirm potential signals.

When the MACD line crosses above the signal line, it’s often seen as a buy signal, hinting that upward momentum may be gaining strength. If the MACD line falls below the signal line, it’s often considered a sell signal, suggesting downward momentum might be on the horizon.

The histogram, a series of bars that rise and fall above or below a zero line, shows the difference between the MACD line and the signal line. This visual aid can help traders quickly spot shifts in momentum. When the bars grow taller, momentum is increasing, while shorter bars may indicate that momentum is weakening.

Introducing Price Channels and Their Role

Price Channels are another essential tool in technical analysis. These channels are simply bands, or lines, drawn above and below a stock’s price, forming an upper and lower boundary. The idea is to track the high and low points of the price over a specific period. When the price moves outside these boundaries, it often signals a potential trend reversal or breakout, indicating that it might be time to re-evaluate positions.

Price Channels can help traders understand overbought or oversold conditions. If the price breaks above the upper boundary of the channel, it may signal that the asset is overbought—meaning its price may soon fall back. Conversely, if the price falls below the lower boundary, it might be oversold, suggesting a bounce upward could be coming.

These channels don’t just give traders potential buy and sell points; they help in setting realistic expectations for price movement. By observing how the price behaves within the channel, traders can gauge potential support and resistance levels.

Combining MACD and Price Channels for Better Insight

While each indicator is powerful on its own, combining MACD and Price Channels can offer more comprehensive insights. Here’s how they complement each other: the MACD provides clues about momentum, while Price Channels show potential overbought or oversold conditions. Together, they can strengthen a trader’s sense of timing and direction.

For example, imagine the price of a stock is reaching the upper boundary of a Price Channel. This could suggest the stock is nearing an overbought point. Now, if the MACD line is about to cross below the signal line at the same time, it adds weight to the idea of an upcoming price drop.

Similarly, if a stock price breaks below the lower boundary of a Price Channel and the MACD shows a bullish crossover (the MACD line crosses above the signal line), this combination could suggest a possible price rebound.

Another key aspect of this combo is avoiding false signals. Both indicators can produce their own share of false alarms, but using them together adds a level of confirmation. If both the MACD and Price Channels signal a similar trend, it increases the odds that the signal is accurate.

Integrating these indicators doesn’t guarantee profits, of course. But it does allow traders to cross-check their analysis, reducing the risk of relying on one tool alone. Always remember to research thoroughly and consult with financial experts before committing to any trades, as no indicator can predict outcomes with complete certainty.

Conclusion

Trading strategies aren’t one-size-fits-all. Combining MACD and Price Channels provides one method for adding depth to your analysis, but it’s vital to practice and refine any approach before using it with real money. And of course, always reach out to a financial advisor to discuss strategies suited to your goals. Whether you’re a seasoned trader or a newcomer, these indicators may bring valuable insights when used thoughtfully.